US can't reverse re

Shi Yu/China Daily。

The world is watching closely as the United States and China engage in high-stakes bilateral trade negotiations. While the immediate outcomes may be modest tariff adjustments or managed market access in selected sectors, those can be best understood as tactical responses to deeper structural tensions rather than strategic breakthroughs. The broader implications for global trade lie not in the specifics of such negotiations but in the shifts they signify: away from multilateralism and US dollar hegemony, and toward a new, multipolar global trade architecture.。

At the heart of the current tensions is the US' growing anxiety over its relative decentering. Having enjoyed more than three decades of the unrivalled global hegemony since the end of the Cold War, the US now finds itself challenged by China's rising technological prowess, industrial scale and global integration. Under the Donald Trump administration, the US' anxiety has transformed into an explicitly transactional, bilateral trade posture.。

The US has been increasingly dismissing multilateral institutions — for long the instruments through which Washington shaped global norms and gained geopolitical advantage — in favor of "deal-making" with individual countries, and projected this bilateralism, steeped in zero-sum logic, as strength. By doing so, it has exposed its strategic incoherence.。

For example, through its trade policy, the US administration tried to simultaneously increase domestic manufacturing output — by penalizing imports — and maintain the dollar's status as the global reserve currency. These goals are not easily reconciled. A strong global reserve currency fuels persistent trade deficits. Penalizing imports through tariffs does disrupt this dynamic but not without costs. If the US were to genuinely reindustrialize at scale, it would need to import huge volumes of capital goods and intermediate inputs, exacerbating the very trade deficit it seeks to narrow. The paradox is that narrowing the trade deficit would first require widening it.。

The alternative is simply to reduce overall aggregate demand in the economy by slashing public expenditure. That doesn't look like happening.。

More fundamentally, the hollowing out of US manufacturing was never principally a result of trade agreements. It was a symptom of a deeper reorientation of US capital. Over the past four decades, US capital has been progressively reallocated from industrial production to financial engineering, creating asset bubbles, stock buybacks and speculative real estate investment. Wall Street flourished as "Main Street" faded. The share of GDP derived from financial services soared, while fixed capital formation in manufacturing stagnated. Reversing this trend would require reducing the political and institutional power of finance, an unpalatable proposition for any administration.。

Yet the US still manufactures products such as high-end equipment and advanced electronics, and develops or advances technologies like aerospace technology and military technology. But their production is capital-intensive, not labor-intensive, and they don't fill the physical or emotional void created by the offshoring of everyday consumer goods manufacturing that began in the 1970s. The sense of economic alienation among broad swathes of the American working class is as much cultural as it is economic. Tariffs may meet some symbolic need for control or retribution, but they cannot restore the industrial base to its past state.。

Also, the rest of the world is adapting to the US' contradictions. The weaponization of the dollar, through sanctions and arbitrary financial restrictions, has catalyzed a slow but deliberate move toward alternatives. Some emerging economies are accelerating trade settlements in their national currencies and exploring alternative clearing mechanisms. ASEAN member states, on the other hand, are reducing their reliance on the dollar in regional trade, particularly with China, Japan and the Republic of Korea.。

Even the oil-rich Gulf Cooperation Council member states are diversifying their trade currency strategies. The demand for the dollar as a trade settlement medium is gradually diminishing, which the European Central Bank sees as an opportunity for the euro to play a more prominent role in global trade. This fragmentation is not a retreat from but a reconfiguration of globalization.。

The new globalization that is emerging is multipolar in character, regional in structure and decentralized in operations. Institutions such as the World Trade Organization will likely persist, offering an overarching framework for administrative and policy guidance. But much of the practical work of trade governance — harmonization of standards, digital commerce rules and investment arbitration — will occur in regional and bilateral forums. In this regard, the US-China negotiations are not anomalous but emblematic.。

For many countries, especially in the Global South, the US' retreat from multilateralism poses risks but also creates new space. The growing importance of South-South trade, supported by new infrastructure financing and currency swap arrangements, is reducing the Global South's dependence on Western markets and institutions, with the Belt and Road Initiative creating corridors of trade and production that bypass traditional Western trade bottlenecks.。

The US remains a major consumer market, responsible for about 14 percent of global imports. But its share in the global economy is declining, reflecting both its waning economic clout and the diversification of global demand. For exporters, aligning with the new regional poles of growth — in East Asia, South Asia and parts of Africa — will become increasingly important. And supply chains will be restructured to hedge against geopolitical volatility, balancing proximity, cost and political risk.。

The Sino-US trade tango should not be seen as the primary determinant of the future of global trade. Rather, it is a mirror of the broader historical shift: from unipolarism to multipolarism, from dollar dominance to currency diversification, from multilateralism to mosaic regionalism. The world isn't de-globalizing; it is re-globalizing on new terms and under new rules.。

The author is an adviser to former Australian prime minister Kevin Rudd, adjunct professor at Queensland University of Technology and a senior research fellow at Taihe Institute.。

The views don't necessarily reflect those of China Daily.。

(责任编辑:焦点)

-

“咿呀……”伴跟着洪亮的锣鼓,一声亮堂高腔打破喧嚣,直上云霄。5月25日,在第七届湘鄂赣皖非物质文明遗产联展现场,湖南省湘剧院青年艺人曹威治携湘剧《拜月记》登台露脸,水袖起落、顾盼生辉,这一幕恰似六百

...[详细]

“咿呀……”伴跟着洪亮的锣鼓,一声亮堂高腔打破喧嚣,直上云霄。5月25日,在第七届湘鄂赣皖非物质文明遗产联展现场,湖南省湘剧院青年艺人曹威治携湘剧《拜月记》登台露脸,水袖起落、顾盼生辉,这一幕恰似六百

...[详细]

-

刚刚!合肥邃古可口可乐2022年“全国无废”环保公益展在六家畈发动

合肥热线讯。 6月18日,2022年全国无废环保公益艺术展首展成功举行。本次展会以“可乐瓶再重生、循环在产生”为主题,用多种方式突出了“全国无废”的理念

...[详细]

合肥热线讯。 6月18日,2022年全国无废环保公益艺术展首展成功举行。本次展会以“可乐瓶再重生、循环在产生”为主题,用多种方式突出了“全国无废”的理念

...[详细]

-

在这骄阳似火的六月,咱们迎来了父亲节。每年6月的第三个星期天是“父亲节”,为了让孩子感触父爱的忘我与巨大,表达对父亲浓浓的爱,2022年6月15日至6月17日,在合肥市长江路幼

...[详细]

在这骄阳似火的六月,咱们迎来了父亲节。每年6月的第三个星期天是“父亲节”,为了让孩子感触父爱的忘我与巨大,表达对父亲浓浓的爱,2022年6月15日至6月17日,在合肥市长江路幼

...[详细]

-

不合法金融广告是指违背法律法规要求,推销金融产品或服务的广告。不合法金融广告所传递的信息往往是过于夸张、引人误解或许虚伪不实的,简单使金融顾客对产品收益产生误解、忽视潜在的危险以及认知产生偏差等,然后

...[详细]

不合法金融广告是指违背法律法规要求,推销金融产品或服务的广告。不合法金融广告所传递的信息往往是过于夸张、引人误解或许虚伪不实的,简单使金融顾客对产品收益产生误解、忽视潜在的危险以及认知产生偏差等,然后

...[详细]

-

5月13日17时,22岁的怀化姑娘张雅婷遭受事故,生命垂危,经医院全力抢救无效,生命之花就此凋谢。妈妈田女士考虑一再,决议捐赠孩子的角膜,为别人留下光亮。由于张雅婷时刻短的人生,和她想要“成为”的,都

...[详细]

5月13日17时,22岁的怀化姑娘张雅婷遭受事故,生命垂危,经医院全力抢救无效,生命之花就此凋谢。妈妈田女士考虑一再,决议捐赠孩子的角膜,为别人留下光亮。由于张雅婷时刻短的人生,和她想要“成为”的,都

...[详细]

-

民生银行合肥分行展开“遍及金融常识,守住‘钱袋子’”金融常识教育宣扬活动

为遍及金融常识,进步金融顾客防备金融欺诈才能,看护市民的“钱袋子”,6月6日,在人民银行合肥中心支行指导下,我国民生银行合肥分行展开“遍及金融常识 守住&lsquo

...[详细]

为遍及金融常识,进步金融顾客防备金融欺诈才能,看护市民的“钱袋子”,6月6日,在人民银行合肥中心支行指导下,我国民生银行合肥分行展开“遍及金融常识 守住&lsquo

...[详细]

-

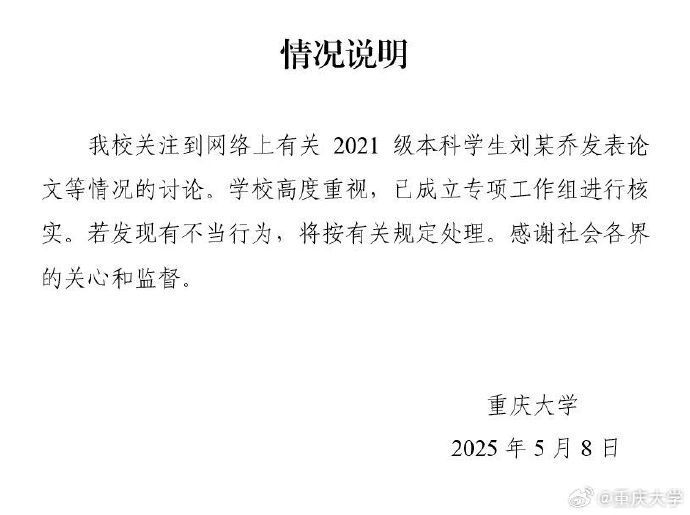

大四本科生已发14篇SCI论文?重庆大学:建立专项工作组核实

央视网音讯。:5月8日,重庆大学发布状况阐明称,重庆大学关注到网络上有关2021级本科学生刘某乔宣布论文等状况的评论。校园高度重视,已建立专项工作组进行核实。若发现有不妥行为,将按有关规定处理。新闻链

...[详细]

央视网音讯。:5月8日,重庆大学发布状况阐明称,重庆大学关注到网络上有关2021级本科学生刘某乔宣布论文等状况的评论。校园高度重视,已建立专项工作组进行核实。若发现有不妥行为,将按有关规定处理。新闻链

...[详细]

-

110余家单位组团赴南京揽才 博士后单人最高可获赞助超150万元

“博聚楚天·共建支点”湖北省2025年南京引才活动现场气氛火热。 省人社厅供图)。湖北日报全媒记者 王成龙。通讯员 楚仁轩。5月8日,“博聚楚天·共建支点”湖北省2025年南京引才活动在南京大学举办。

...[详细]

“博聚楚天·共建支点”湖北省2025年南京引才活动现场气氛火热。 省人社厅供图)。湖北日报全媒记者 王成龙。通讯员 楚仁轩。5月8日,“博聚楚天·共建支点”湖北省2025年南京引才活动在南京大学举办。

...[详细]

-

中新网5月25日电 据法新社报导,美国哥伦比亚金迪奥省警方表明,当地时间24日,亚美尼亚大学的一辆大巴在游览途中失控冲下桥梁,形成9人逝世,7人受伤。据报导,当天,该大巴载着3名教师和23名学生从托利

...[详细]

中新网5月25日电 据法新社报导,美国哥伦比亚金迪奥省警方表明,当地时间24日,亚美尼亚大学的一辆大巴在游览途中失控冲下桥梁,形成9人逝世,7人受伤。据报导,当天,该大巴载着3名教师和23名学生从托利

...[详细]

-

-END-。

...[详细]

-END-。

...[详细]

“三夏”出产一线调查|智能农业“慧”丰盈

“三夏”出产一线调查|智能农业“慧”丰盈 守住钱袋子,护好美好家!安全人寿安徽分公司展开防非常识进社区活动

守住钱袋子,护好美好家!安全人寿安徽分公司展开防非常识进社区活动 “非遗+科技”走进大学讲堂 大学生绣郎飞针走线

“非遗+科技”走进大学讲堂 大学生绣郎飞针走线 湖北遭受强降雨气候,多地呈现暴雨、雷暴劲风等极点气候

湖北遭受强降雨气候,多地呈现暴雨、雷暴劲风等极点气候 北京客厅“落日音乐会”上最浪漫一幕 和田农牧民演唱《国家》嗨翻全场

北京客厅“落日音乐会”上最浪漫一幕 和田农牧民演唱《国家》嗨翻全场